To do your own calculation of Debt to Income, I use Omni Calculator all the time. They use this number to determine what the risk is to lend to you. The banking standard is to calculate based on your gross pay vs your monthly expenses. The debt to ratio income calculates based on your current debt divided by your gross income. How To Calculate The Largest Expense For A Family Of 4įirst up you must calculate your debt to income (DTI) ratio and percentage of your income is available for housing costs. We’re covering the 30% rules, the 28/36 rule as well as your debt to income ratio, and how that can impact what you can afford. and can vary substantially within a state depending on the part of your state or even just the part of your town. Housing costs vary drastically across the U.S. There are different approaches and different factors involved. You need to clearly commit to following the standards for housing affordability. What you can afford vs what you actually pay is often a huge factor in getting into debt. How Much House/Rent Can I Afford On A $50k Salary? These are the focus areas for to budget for family of 4 making 50k or even making 200k, your favored four are the primary important expenses in your monthly family budget plan. Using the 70% take home calculation your annual living income is: A good free tool to use is ADP’s income calculator. However, this can vary state by state and also may include things like union dues, so check your state’s taxes, how many you claim, etc.

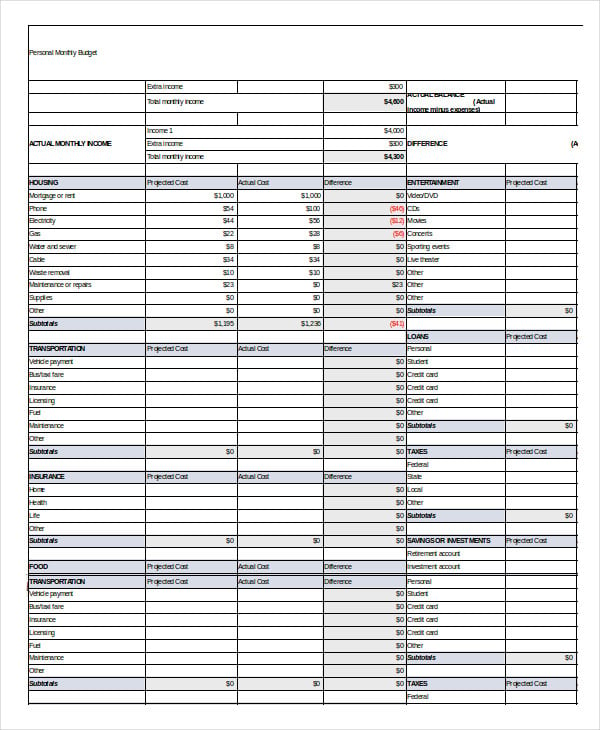

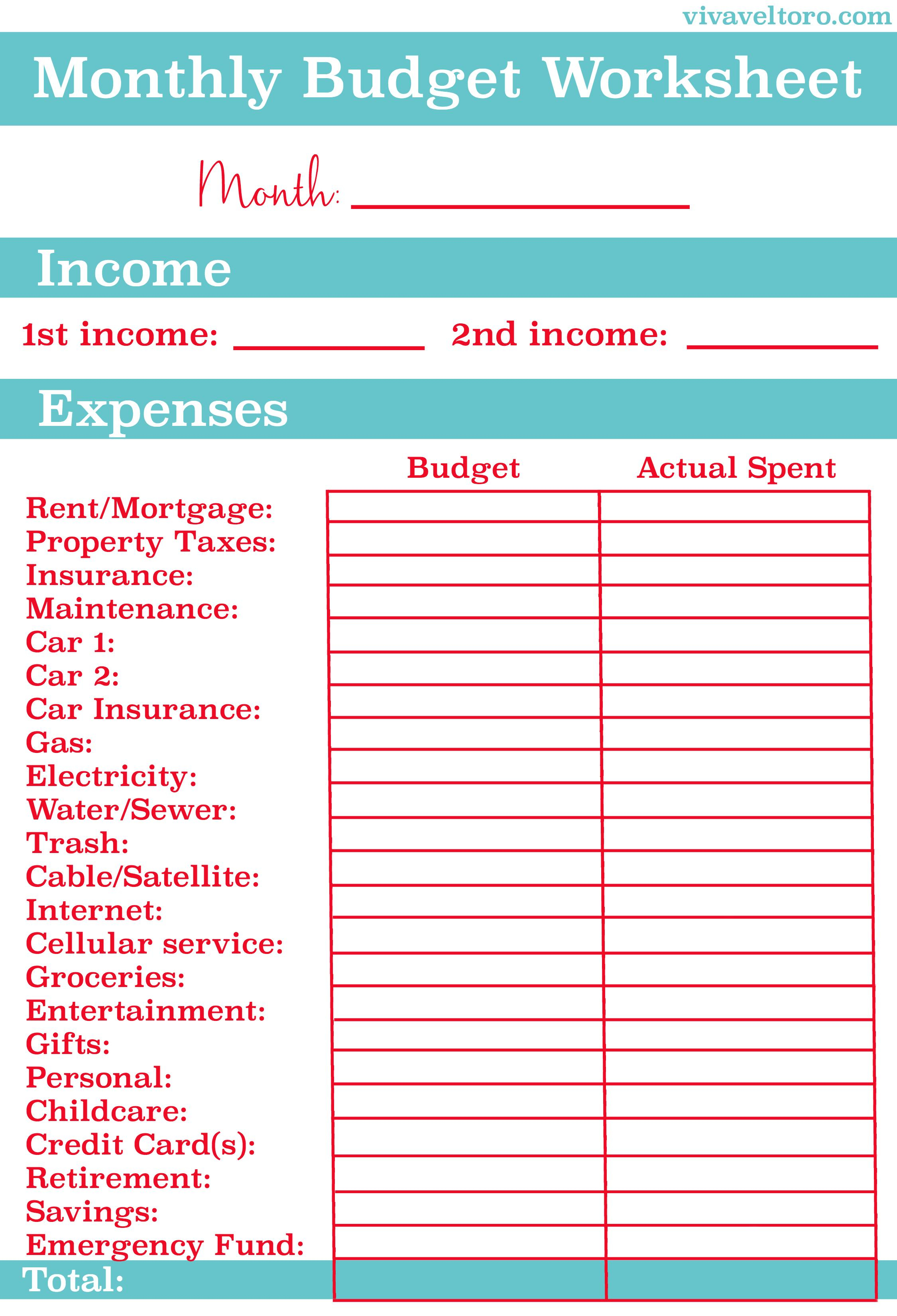

On average you want to estimate 25% taken out of your paycheck. Your salary is 50k but what is your ‘net income’, your take home pay? Let’s say you just accepted a job offer for 50k and you want to calculate what your net income is. Once you start this process you are on your way to starting your family of four budget plan. Then we’ll go through how to realistic limits for yourself so that you don’t overspend throughout the year. Part 2 is making a list of all monthly expenses such as rent/mortgage, car payments, loans, property taxes, etc. These will be things like groceries, entertainment, school supplies, etc. The first step is to start tracking all of your expenses before creating your plan to get an accurate idea of how much money you actually spend each month. Where To Start With Your Monthly Budget Plan For A Family Of Four You’ll find ways to live and enjoy a life that isn’t filled by only material things, how to thrive as a family with common goals. How Can A Family Budget Plan Make A Difference?Ī family budget plan can help you know where your money is going, what is due when and even find ways to save towards future goals, big and small.Ī budget plan is there to let you know where every penny’s place is. If anything, you need this family budget plan more than most. A budget for a family of 4 making 50k is no exception. Yes, everyone needs a monthly family budget. Do We Really Need A Monthly Family Budget? We’ll want to look at ALL your expenses to create your family budget plan. You may think you do, but I’m betting there are details you either didn’t see or chose not to acknowledge in your family spending habits. You’ll need to know where all your money is going.

We’re going to practice ‘a place for every penny and a penny in it’s place’. It’s not going to be easy and you certainly won’t be “keepin’ up with the Joneses” You’ll need to commit to a strict spending plan and make smart choices at every corner.

A budget for a family of four making 50k can be done. Is It Realistic To Think A Family Of Four Can Survive On 50k?

0 kommentar(er)

0 kommentar(er)